February Market Update – Australian FMCG and CPG

for Sales, Marketing & Category

We are seeing many exciting changes in the market already for 2024, but none more so, than the exciting things that are happening here at [axr] Recruitment & Search that will help you to better understand what’s happening in the world of recruitment, and where your role fits into this!

- We’ll soon be recording our annual year in preview pod detailing our recruitment forecasts for 2024. Look out for it in the coming month!

- February will also see the launch of the [axr] 2024 Salary Guides. Not only do they give you the most accurate and up-to-date information on salary levels across sales, marketing, and category, but they will also give you a unique insight into the differences in each role level to help you plot your next career move. If you haven’t yet signed up for our Salary Guides, you can do so here.

So, how has the market started in 2024 for sales and marketing recruitment? Here’s what we are seeing:

Sales

In a long-term-trend turnaround, the National Business Manager (NBM) role is back! We’re currently shortlisting our 5th role in as many weeks. That’s more roles than in the whole market last year. So, why is there such a strong demand for the NBM? This role naturally addresses the gap we’ve seen growing between the National Account Manager (NAM) and Customer Director. While the NAM role has got bigger, and the Senior National Account Manager (SNAM) title is seeing a resurgence, the NBM role comes with leadership, P&L ownership, and complexity. It offers a great testing ground for future leaders. Many used to find their career peaked at NBM, which then created talent blockages, but demand today is for sales directors of the future.

Marketing

We’ve talked for 4 months about the softer demand for talent in marketing. Well, the times, they are a changin’! Advertised roles for Brand and Senior Brand Managers increased significantly throughout December 2023 and continued through the traditionally quiet month of January. Customer/Trade and Shopper marketing demand is also steadily increasing as organisations see 2024 as an opportunity to win in store, with the RBA hinting at a softening in interest rates and the cost of living crisis starting to ebb. In our last blog, we called out 2024 as the year of the contractor. Early signs are this could be the case. On the senior end, we have already seen more opportunities this year compared with a very quiet 2023, and are hearing positive noise about the next 6-12 months – so, now’s the time to get ahead of the game and reach out to our team!

Category

Demand remains steady in category development and category strategy. Organisational confidence is led by economic indicators, and category is seen as the function to unlock opportunity in times of change. The sweet spot of interest rates, employment and consumer demand being in balance, does seem like a potential reality for the end of 2024, as long as we don’t have another global crisis. Don’t mention the Red Sea!

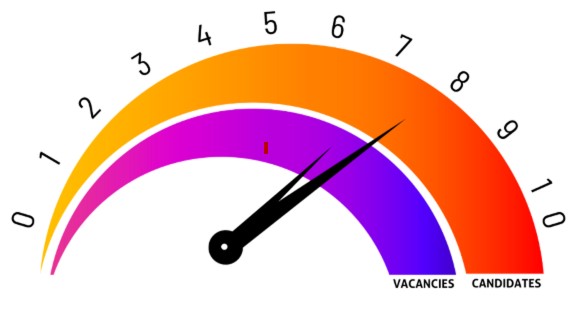

Our “[axr] How’s The Market Barometer” this month reflects vacancy numbers and candidate supply.

VACANCIES: 7 out of 10. This number is up slightly higher than December, which was sitting at a 6 out of 10.

CANDIDATES: 8 out of 10. There is an oversupply of candidates at the moment, in part due to the long-term soft demand for senior marketing talent.

Overall, the market is still at mid-strength.